How To Write A Donation Receipt

Adobe PDF Microsoft Word docx Open Document Text odt 1 Acquire A Copy Of The Clothing Donation Tax Receipt. How to Write a Donation Receipt that is Tax-Compliant.

Nonprofit Donation Receipts Everything You Need To Know

Learn how to write a business letter of acknowledgment with helpful phrases a sample letter and tips and hints on crafting such correspondence.

. Make a list of names and addresses of donors. Types of Donation Letter. Check out Bloomerangs annual fundraising appeal letter writing.

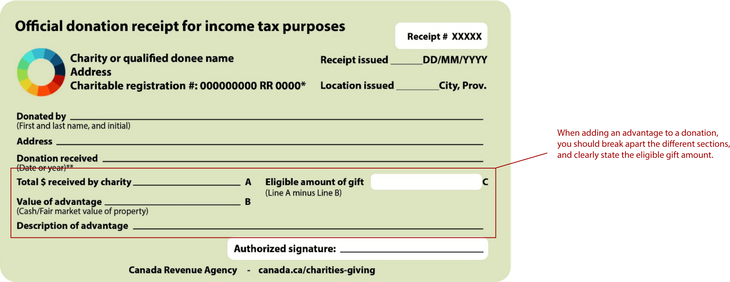

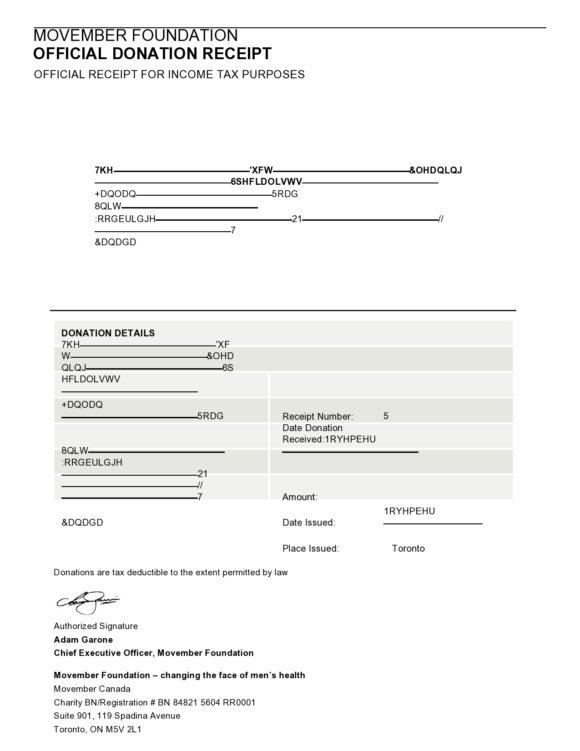

Write out the full date that you made the sale and a chronologically ordered receipt number under it. The receipt can take a variety of written forms letters formal receipts postcards computer-generated forms etc. You need to pay attention to the layout of your donation receipt template when you intend to create the template yourself.

As you know we started this. Ad Build a Word Compatible Receipt Today - Export and Print Start For Free. Write the letter by hand.

Often this means you lose out on tax deductions or even cause. How do I write a donation receipt. Accept Online Donations Securely.

Write the receipt number and date on the top right. Ad Grow Support And Boost Online Donations With Customizable Donation Forms For Your Website. Regulations regarding donor receipts are.

Its confusing to the donor to receive a thank-you email and then a separate. Here are the basic things you should have in mind if you are in the process of writing an appreciation letter to donors. In most cases donated vehicles that sell for less than 500 are.

The IRS requires an official tax receipt for donations over 250 but its a good practice to issue receipts for smaller donations as well since many. Shop Receipt Forms Today. And you must provide a bank record or a.

It would be wiser. Thank you letter for donation template. Most of the donation letters are written for some humanitarian cause.

Ad Grow Support And Boost Online Donations With Customizable Donation Forms For Your Website. The IRS reminds everyone giving to charity to be sure to keep good records. The simple receipt should be signed by a representative of the business receiving the payment.

How to Write a Clothing Donation Receipt. Claiming deductions without a receipt can be a tricky part of doing your tax return and it is certainly not recommended. Writing the letter by hand is a lot more personal than if you were to type it or buy a sympathy card from a shop though you may.

Thanking your donors for their contributions and letting them know how grateful you are for their support is a key element of successful church. How to Write a Vehicle Donation Receipt. There are two main types of.

This type of receipt is also known as a sales receipt template. Include a tax receipt. Ad Professional Quality Multi-Part Custom Carbonless Forms More.

Create Edit Print A Receipt For Word- Easy To Use Platform - Try Free Today. If claiming a deduction for a charitable donation without a receipt you can only include cash donations not property donations of less than 250. Your charitable donation must be made to a qualified organization and the amount you can deduct depends on the type of donation youre making.

How to write a condolence letter. If the IRS qualifies the organization receiving the donation as having tax-exempt status the donation receipt is then used to claim a deduction on the donors income tax return. The nature of the contribution requested can be different.

Updated June 03 2022. Donation Thank You Letter. Ad Easily Track Your Business Receipts - Get Started With QuickBooks Today.

A donation receipt can be rejected by the IRS if the information needed is not provided. For best results write a personal acknowledgment letter that includes the IRS-required elements. Make a list of everyone you need to thank.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. Dear donor names I want to take the time to sincerely thank you for your donation to fundraiser name. A tax write-off for a car donation is a way that you can a benefit from the non-cash charitable donation of a motor vehicle.

Adobe PDF Microsoft Word docx Open Document Text odt 1 Save Your Copy Of The Vehicle Donation Receipt. 1 PDF editor e-sign platform data collection form builder solution in a single app. If your thank-yous are the result of a party in your honor write down the names of those who sent or brought a gift whether it came.

A lot of non-profit organizations give out their donation receipts at the end of the year when the donation has been given or in the first month of the next year. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. A 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or moreIts utilized by an.

Once you write a solid donation letter template you can build on it for campaigns and years to come. Ad Answer Simple Questions to Make A General Receipt On Any Device In Minutes. By law special recordkeeping rules apply to any taxpayer claiming a charitable contribution.

Accept Online Donations Securely. Create Legal Documents Using Our Clear Step-By-Step Process. Each receipt should have.

501c3 Tax-Compliant Donation Receipt Requirements.

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Pdf Templates Jotform

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Templates Samples Word Pdf Eforms

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Donation Receipt Templates Silent Partner Software

Post a Comment

Post a Comment